Explain the Different Elements of Budgets and Estimates

It is less rigid. An estimate is an approximation while a budget is some type of financial plan.

Cost Management Explained In 4 Steps

Budgeting is an integral part of running a business efficiently and effectively.

. Its the different phases of budget planning and implementation through different budgeting periods. We can broadly divide these elements of cost into three categories. In a manufacturing organization we convert raw materials into a finished product with the help of labor and other services.

Learn more about the two types of budgets that companies commonly use. The second point represents the pessimistic estimate where work is done and funds spent in the least efficient manner. Budgeting is made up of different types.

There are many different types of project estimation techniques used in Project Management with various streams like Engineering IT Construction Agriculture Accounting etc. Large commercial projects can have project budgets that are several pages long. It is of two types.

1 minute Reliable cost estimates are necessary for all projects. Usually a project estimate becomes a project budget after the client approves the project estimation. It refers to the estimated expenditure of the government on various developmental as well as non-developmental programs during a fiscal year.

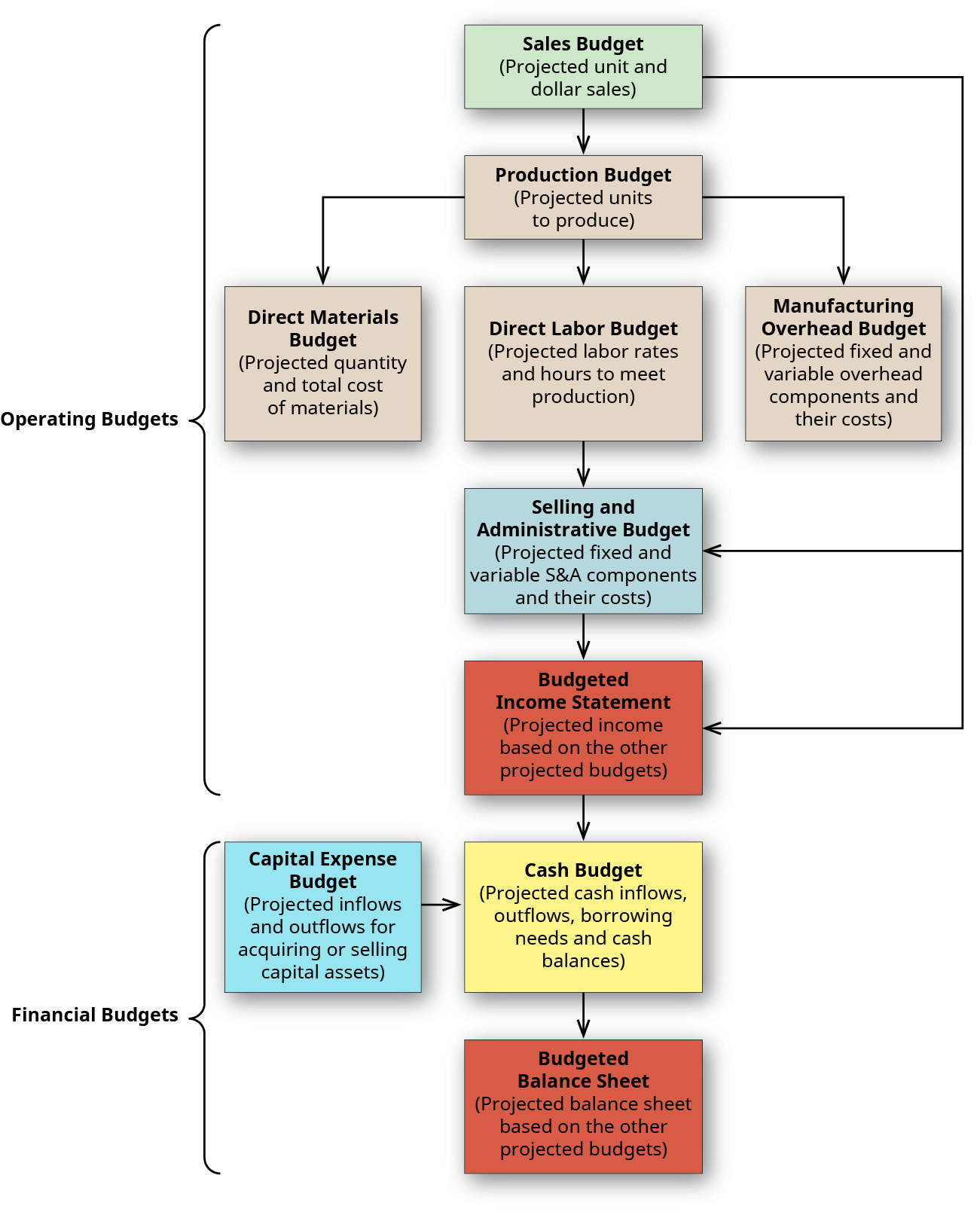

Operating budget of the business involves costs related to the operational activities. A business budget typically progresses in phases that in total produce a complete budget life cycle. The project budget determines the total cost allocated by the client for the project.

Cash disbursements cash receipts net change in cash and new financing writes Arthur J. This can also occur with a portion of a project you know. Contains the net income of the company and gives a general financial overview of how the company is doing.

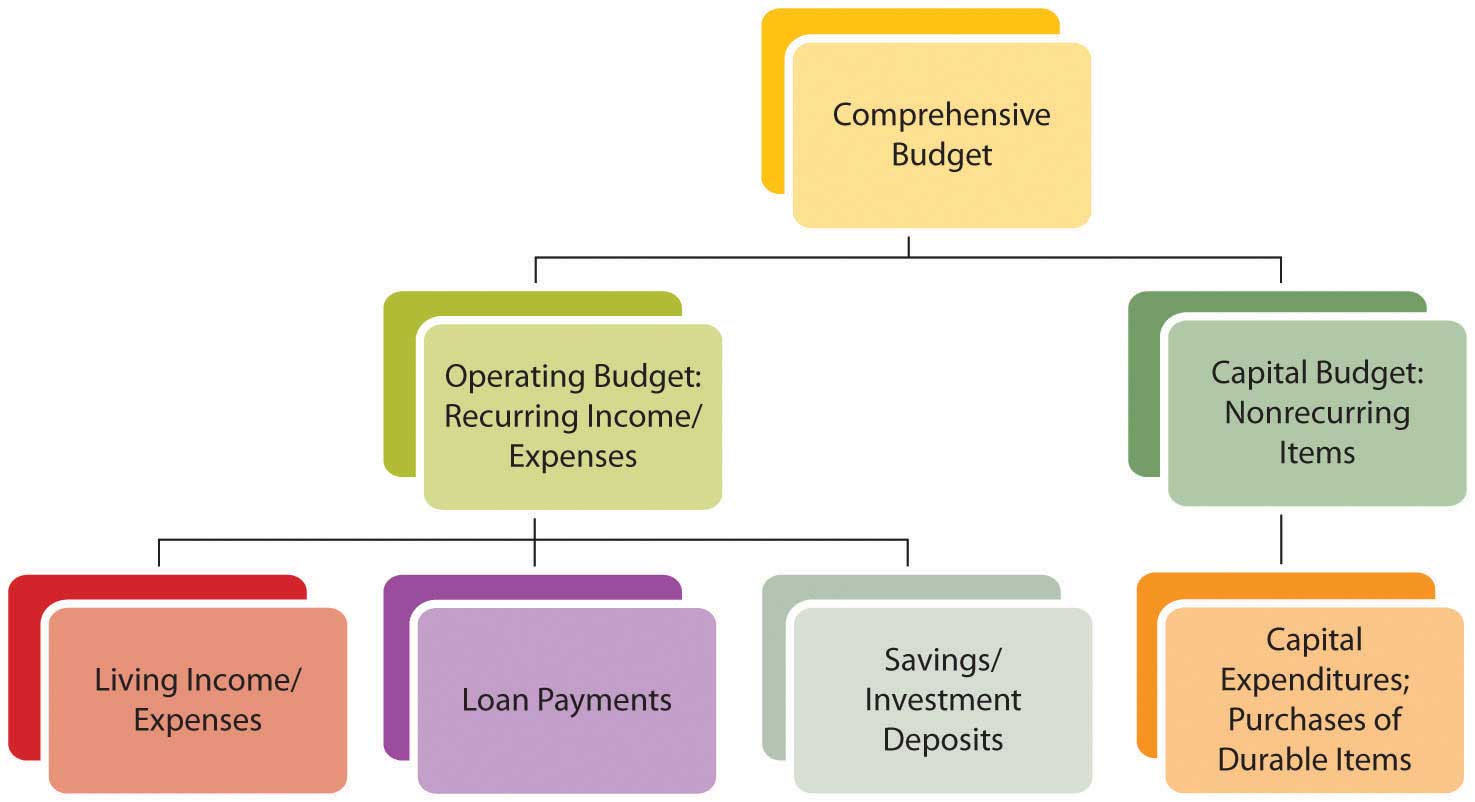

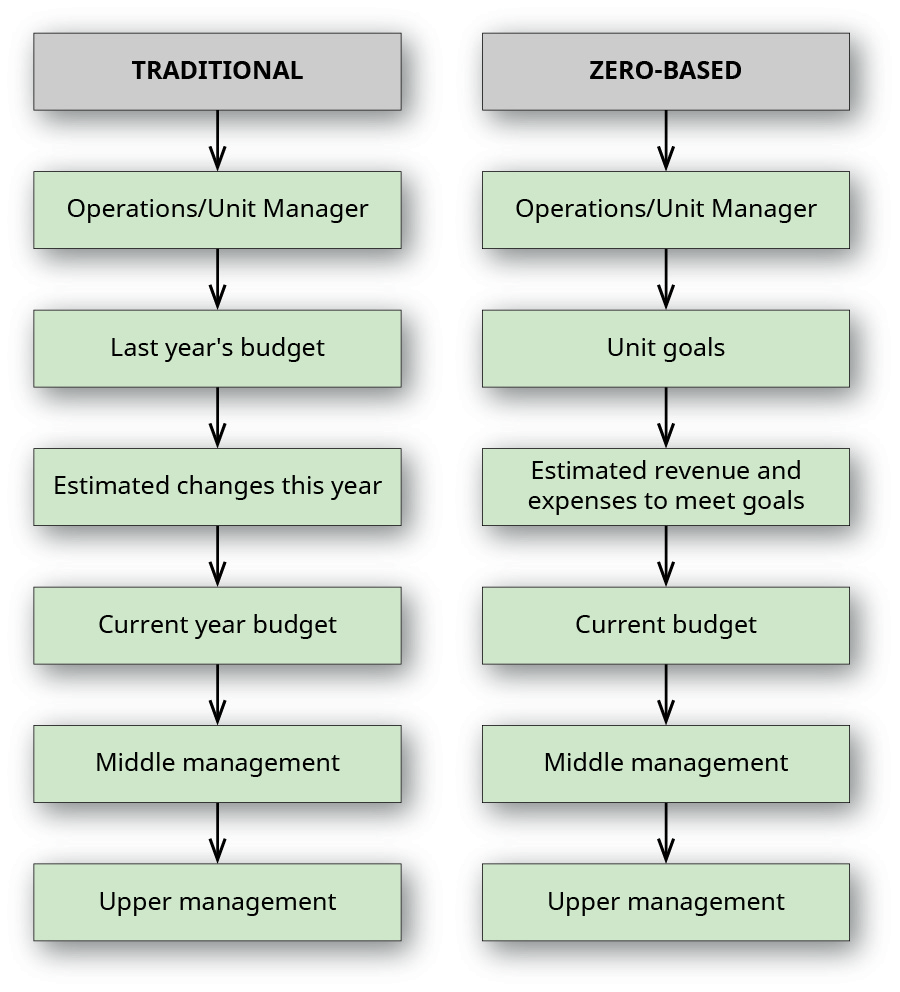

There are a number of alternative budgeting models available. In the process of cost estimation the Project Cost Engineer uses either one or the combination of the following. A business creates a budget when it wants to match its actual future performance to an ideal scenario that incorporates its best estimates of sales expenses asset replacements cash flows and other factors.

The main output for determining the budget includes cost performance baseline. B Pessimistic Estimate. A Optimistic Estimate.

The first point represents an optimistic estimate where work is done and funds spent most efficiently. The disbursements section The cash excess or deficiency section. Without a cost estimate it would be impossible to prepare a business plan establish detailed budgets predict resource requirement or control project costs.

Such projects often have a large number. A budget can help you plan your business activities and can act as a yardstick for setting up financial goals. According to the above definition the essential elements of a budget that average are.

A budget is defined as a comprehensive and coordinated plan expressed in financial terms for the operations and resources of an enterprise for some specified period in the future. A project budget template includes a detailed estimate of all costs that are likely to be incurred before the project is completed. Budgetary control is used in all functional areas of an organization it is more extensive.

Although the terms used to identify the four phases within the. Regardless of its focus the budget cycle begins with planning and ends with a thorough evaluation. The cash budget is composed of four major sections.

Budgets are estimates on the basis of past experience. Top Down estimating Often an estimate is determined at the project level top and apportioned down to the tasks. The income flow includes the sales of the business.

A business budget is a spending plan for your business based on your income and expenses. The elements of cost are those elements which constitute the cost of manufacture of a product. It identifies your available capital estimates your spending and helps you predict revenue.

The historic data is used as the baseline to formulate the budget for the following year. Once the budget is ready it needs to be approved by the department heads and the top management. In addition you can produce a project estimate based on top down or bottom up techniques.

The inputs for determining budget includes following Project management budgeting methods. The incremental budgeting technique uses historic income and expenditure data as a starting point. Budget is a plan of action for a defined period.

These services are Material Labour and Expenses. It is of two types. Depending on the size of your business you may have a larger or smaller sales budget spreadsheet than others but all sales budgets should include three key elements.

All direct material direct labour and direct expenses are added to get prime cost. The receipts section lists all of the cash inflows except for financing expected during the budget period. It refers to the estimated receipts of the government from all the sources during a fiscal year.

They are Material Labour and Expenses. Keown in the book Foundations of Finance A cash budget is important because it allows administrators to timely identify periods with cash overages and shortages so they can take necessary remedial action. This data is usually acquired from the previous years budget accounts or a combination of the two.

Cash budgets have four distinct elements. Generally the major source of receipts is from sales. The Project Budget is a tool used by project managers to estimate the total cost of a project.

A budget must include targeted revenue and the estimates of expenses that a business needs to incur to meet the revenue targets. Also the budget should consist of any improvements that a company expects to go for in the near term. The costs include production cost overhead cost manufacturing cost labor cost administrative cost working capital etc.

It can be operated without standard costing. Budgets are should be costs. A Project manager is often challenged to align mainly six project constraints - Scope Time Cost Quality Resources and Risk in order to accurately estimate the projectThe common questions.

Elements of a Budget. Elements of Cost in Cost Accounting Again these elements of cost are divided into two categories such as Direct Material and Indirect Material Direct Labour and Indirect Labour Direct Expenses and Indirect Expenses. M Most Likely Estimate.

And the third point represents the most likely scenario which typically falls somewhere in the middle. It not only specifies what cost will be incurred but also when costs will be incurred. Knowledge of these types as discussed here will expose the meaning advantages and disadvantages of such which will definitely guide the manager in his choice of the type to adopt.

Describe How And Why Managers Use Budgets Principles Of Accounting Volume 2 Managerial Accounting

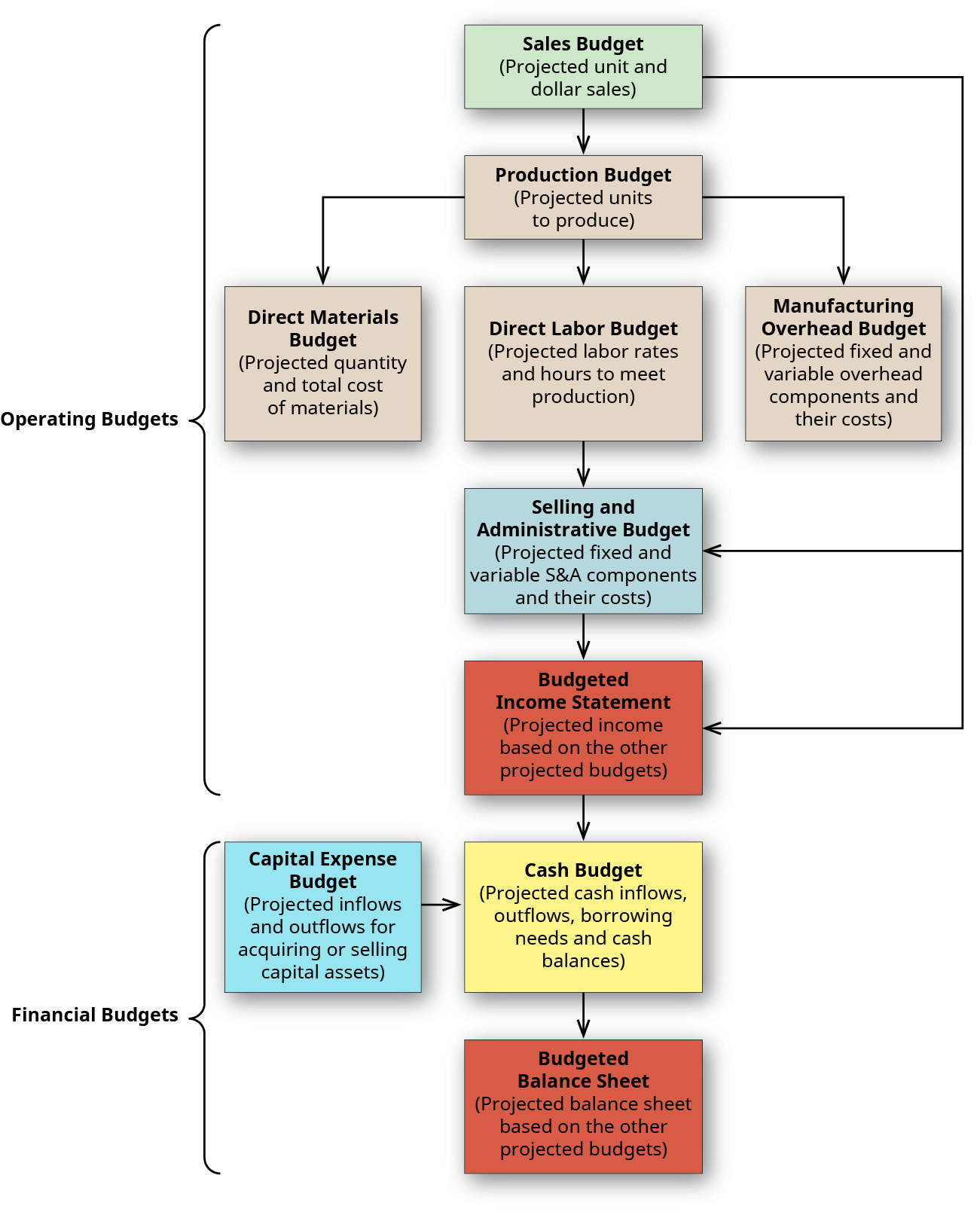

Creating The Comprehensive Budget

Describe How And Why Managers Use Budgets Principles Of Accounting Volume 2 Managerial Accounting

No comments for "Explain the Different Elements of Budgets and Estimates"

Post a Comment